Not so fast

Nowhere is the lexicon of marketing more testosterone-fuelled than in the arena of innovation. Once it was enough to aim for ‘new and improved’, through incremental innovation to an existing product line. No longer. The restless imperative now is to ‘change the game’, to achieve ‘breakthrough’ and, above all, to ‘disrupt’ – an injunction generally accompanied by the threat ‘or be disrupted’.

The effect is to polarise marketing teams as they sit down for their innovation workshops. There are those around the table for whom the bellicose talk of ‘killer innovation’ and ‘big, hairy, audacious goals’ is meat and drink. They revel in the excitement and risk, and can’t wait to traduce the traditions of their own market model in favour of some supposedly disrupting alternative.

Sitting at other stations around the table, increasingly uneasy, are the marketers who wonder why all this upheaval and risk is necessary for their otherwise well-managed, prospering brands. Their typical defence is silence. They may have good ideas, but, since these are on an altogether humbler scale – a new delivery mechanism, for example – tend to hold them for later, when the heat has died down, or file them under ‘quick and dirty’, leaving the big boys to do the category-busting heroics.

If you’re planning such a session for your team, it would be well to be clear about what level of innovation the brand really needs – and why. That clarity starts with a little more discipline in terminology.

Do you, for example, really, truly wish to ‘disrupt’? The term “disruptive innovation” was coined by Harvard academic Clayton Christensen, and has become one of the most casually bandied-about notions in business, with Christensen himself lamenting that it has come to mean “anything people want it to.”

Like most academic concepts, it is more nuanced than it sounds. The theory holds that established brands improve their products along a steady trajectory – ‘sustaining innovation’ – and fail to notice or acknowledge the entry of much lower-priced competitors, which target hitherto unattractive customers with ‘de-featured’ offers. Often as not it is a leaner business model, not a technological leap, that distinguishes these newcomers: think the original easyJet versus the legacy carriers.

Gradually – so the theory goes – the newcomers improve, move up the value chain and sweep the whole market away on their own trajectory, which cuts a swathe across the classical dynamics of the category.

One of the criticisms of the model is that it tends to be better at explaining category-wide shifts after the event than helping individual brands predict when, how and whether to effect their own disruption. Examples of the theory in practice are often cited at the generic level – how the CD industry was disrupted by file-sharing and then iTunes, for instance. Mankind’s adoption of agriculture has even been cited as a ‘disruption’ to the ancient hunter-gatherer way of life.

In my experience it’s all but impossible for marketers of thriving brands to identify the moment when bet-the-business change to the current model is worth the consideration – if it ever is.

So, where does that leave your brand and your team? It may be deeply unfashionable, but the innovation model to which you might need to steer them could still be the incremental kind. Three principles will help you get it right.

First, no single innovation should be expected to transform the fortunes of the brand alone. The aim is momentum, not immediate world domination.

Second, innovations should keep coming. They should be quick-fire and catchy. The brand wins by appealing as the one with a pulse, the one that’s always doing something interesting. Don’t agonise over consumer research and don’t worry about competitors copying; just move on to the next one.

Third, ‘incremental’ doesn’t necessarily mean that innovation is confined to the product itself – it can be manifested at other parts of the offer: packaging, service delivery, distribution channels or digital support. The Husten-Tester diagnostic cough app (see panel) is a great example.

‘Disruption’, ‘breakthrough’ and ‘game-changing’ are concepts that have captured marketers in the way that grand ideas do: they sound sexy; they feel powerful. Words like ‘continuous’ and ‘incremental’, well, don’t.

Perhaps we could do with a little linguistic innovation here, then, and come up with a sexier term.

Your suggestions are welcome. You’ll see mine in the panel.

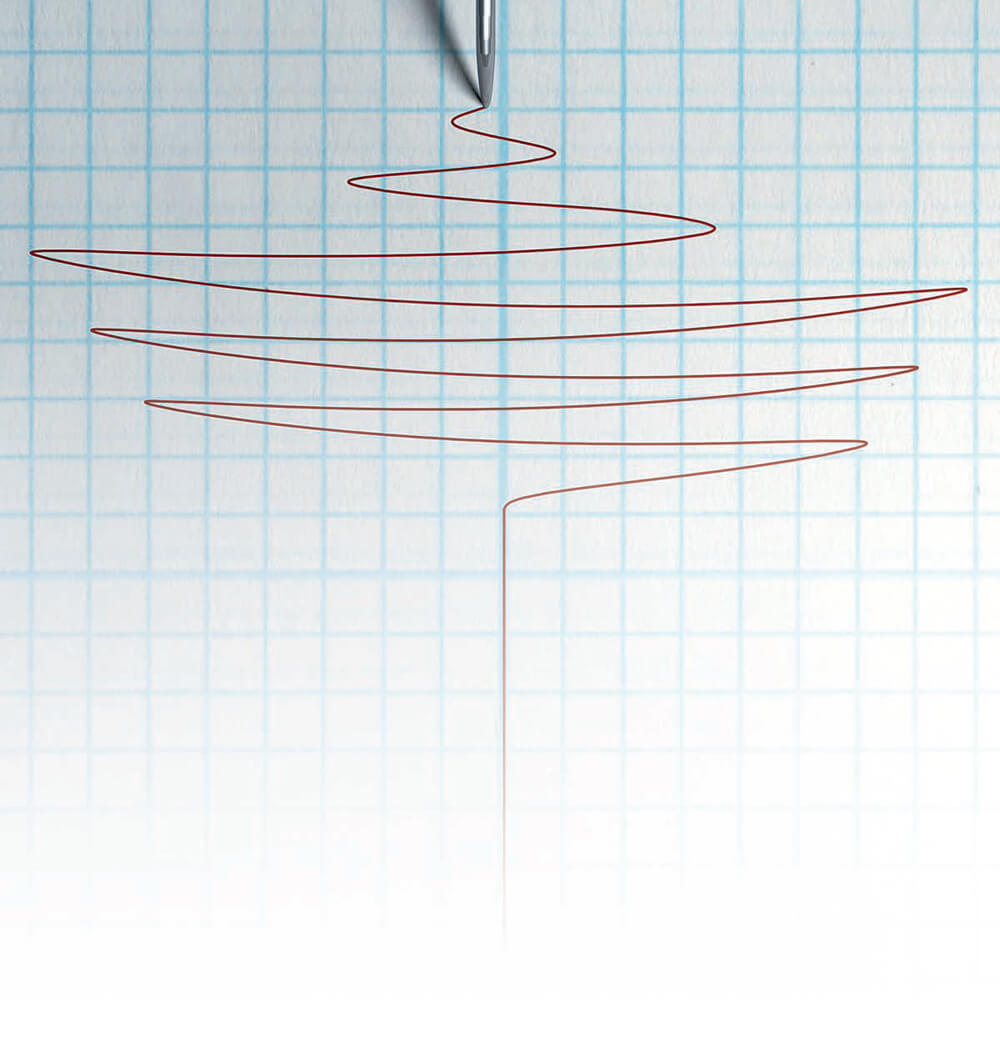

The alternative to the dogma of the single, ‘game-changing’, ‘breakthrough’, ‘disruptive’ innovation. Instead, the brand gains appeal as the one that’s always doing something fresh – with innovations that are fast, imaginative and manifested right across the product-service spectrum.

Avon: one-handed lipstick Being closer to their consumers than any other cosmetics company puts Avon in a strong position to constantly evolve and bring bright new ideas to market. The Pro-to-Go lipstick is one of them. Its one-handed application makes life just that little bit easier – no more juggling the cap, the lipstick and a mirror. Reapply anywhere.

Beohringer-Ingelheim: diagnostic cough app The pharmaceutical company, which owns the global Bisolvon cough-treatment brand, learned from research that most people are unsure whether thy have a ‘dry’ or ‘chesty’ cough. Using voice-recognition software it developed the Husten-Tester diagnostic app: you cough, and from the sound alone it tells you what type you have and how to treat it.

FIdor: interest rates linked to ‘likes’ The German bank has done things differently since its launch in 2009. Its current account pays interest at a rate that rises in proportion to the numbers of ‘likes’ the brand gets on Facebook. The rate is then ‘reset’ each year: it starts at 0.5% and rises 10 basis points for every 2,000 ‘likes’.