Baby Boomerang

Baby boomers face an old age restricted by the hedonistic choices of their youth. Helen Edwards & Derek Day ask how straitened circumstances will affect their spending in retirement

The first baby boomers were conceived in 1946, after the troops returned from the Second World War with apparently one thing on their minds. Women put a stop to the boom in ’64 with their enthusiastic acceptance of the birth control pill. This 18-year cohort became the biggest, richest generation in history, breaking rules and flouting convention from the days of Motown and Woodstock through to the yuppie years and the era of the weblog.

It is also the generation that invented consumption culture. Emerging from the privations of rationing in 1954, boomers learned to flirt with, embrace and capriciously drop the brands that came their way, and marketers have hung onto their coat tails ever since. (See panel below). To follow the boomers was to follow the money.

These have been lucky lives, light on duty and high on thrills, lived through a time of relative peace and unprecedented prosperity. ‘A six-decade party’ is how one boomer website describes it. But is it hangover time now, as this generation ages and the combination of demographics, debt and denial threatens to take its toll?

The first boomers, born in 1946, were bottle-fed OsterMilk and weaned on Farex, brands that survive today. Teething pains were soothed with Steadman’s Powders, a foul-tasting cure-all.

1950s

With rationing finally over in 1954, 8-year old boomers could tuck into Spam Luncheon Meat – a salty mix of chopped pork shoulder and ham that was soon to sell its billionth can worldwide.

In 1957, aged 11, they read The Topper – with Mickey the Monkey on the cover of its novel, double-size format.

As trendy teenagers in 1964, they’d hang out in Wimpy bars and tune in to Radio Caroline – the original pirate station that captured an audience bigger than all three BBC stations put together.

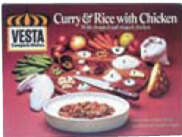

They came of age in 1967. Through their early 20s they made love in Mary Quant cosmetics, poured the grey contents of Vesta Curry packs into their frying pans, and took to the road in the ubiquitous VW Kombi. This ‘box on wheels with the aerodynamics of a sliced loaf’ was the hippy bus of choice from Glastonbury to Kathmandu.

Aged 32 in 1978 they went transatlantic on Laker Skytrain, the brave but doomed low-cost venture that was later to inspire Branson.

1980s

Riding the bull market in the mid-80s, our 30-something boomers wore Reebok and got a deep tan with Bergasol – two things people tend not to do now.

A few pioneered the Motorola ‘brick phone’, weighing around a kilo, and costing £1400.

At 45 in 1991 they discovered Dell. At 50 in 1996 they engaged with BUPA as a claimant for the first time.

2000s

By the turn of 2000, aged 54, the attractions of Clairol Nice ‘n Easy had become all too apparent.

Who knows, by 2010 they could be discussing the merits of Smith & Nephew hips and knees. But look on the bright side, boomers – it’s the price you pay for not dying before you get old.

The demographic time bomb

From this year, British boomers will turn 60 at the rate of 2,800 a day, with, on average, a further 21 years on the clock left to run. Perversely, it is the very size of the generation and its predicted longevity that pose the economic problems. Who pays as the boomers age? Subsequent generations are neither as large nor as prosperous. This tightens the dependency ratio, leaving too few propping up too many for too long: the much-vaunted demographic time bomb. The only way for governments to balance the books is to slash welfare payments down the line, force more patients to pay for medical procedures and put the squeeze on state pensions. In other words, the boomers will have to pay for themselves.

For a generation that has always tended towards a live-for-the-moment ethos, the savings hole is inevitably a big one. A 2004 independent government report assesses the total pensions shortfall at £57 billion.

Most boomers have money locked away in property – predicted to swell to a collective £1,425 billion by 2020, when the bulk of the cohort will be over 60. The realisation is dawning, though, that this will be used neither to fund the good life nor to provide for heirs. It will have to pay for the basics. According to a report from The Prudential, some 12.9 million British boomers expect to use their property to provide for their old age. With so many selling to downsize, or opting for equity release, this is the one force that might finally depress house prices. The Prudential predicts a double-whammy: larger houses will sell for less as supply exceeds demand. Meanwhile those selling to downsize will compete with first timers for smaller properties, pushing those prices up. Boomers will pocket less than they expected.

Boomer denial

Compounding this coming financial squeeze is the boomer psychology. Never mind average life spans, boomers think they’re going to live and stay active for ever. In a recent US survey, when asked to define ‘old age’, a majority quoted an age three years above the average US age of death. Many fully expected to make it to 100. This denial of death – hell no, we won’t go – and an urge to stay in the thick of things throws the issue of finite funds into sharp relief. So much time, so much to do, not so much in the kitty. Something has to give. Perhaps, after all these years, boomers will do the thing they’ve never done: tighten their belts and ease up on consumption. If so, the conventional wisdom on sixty-something marketing will be turned upside down.

DO understand their delusions

They might be getting on, but they don’t accept that their bodies are letting them down. At 62, Keith Richards believed he could still climb a tree and get a coconut for his girlfriend.

DON’T be taken in

70% will have a chronic condition or disability by 65. Boomers will need help to get around physical impairment – like extra-large instrument panels in cars – but it will need to be presented as cool design.

DO innovate

65% of over-55s agreed with the statement: ‘I welcome all technological advances for everyday living’.

DON’T take loyalty for granted

This cohort is more likely to ditch and switch brands than previous 60+ consumers.

DO segment

Boomers have a strong sense of shared history but there are winners, losers, mavericks, mainstreams, actives, passives – as there are for all cohorts.

DON’T refer to ‘grey’ or ‘silver’ consumers

Ever. Even internally. It will guarantee you get your boomer marketing hopelessly wrong.

Winners and losers

The usual-suspect predictions for winner categories tend to focus on financial services, leisure and travel. A greying but still kinda young couple, hand-in-hand on a perfect beach, is the cliché image for all those ‘silver-market’ seminars. It is wide of the mark: you’re unlikely to find this been-there-done-that generation forking out its dwindling reserves on a world cruise. Health tourism, on the other hand, could be a big winner. For example Anita Hildreth, a boomer in her fifties, was told she was ‘too young’ for the new hip she needed to be provided on the NHS. To go private in this country would mean an £11,000 bill. So, following advice from her specialist, she flew to Chennai, on India’s east coast, where the surgeons are superb and the costs are low. For the operation and the travel she paid just £5,100.

Financial services should hold up, as boomers seek to ring-fence the resources they have, but look for losers among branded essentials, fashion and leisure equipment as they prioritise experience over acquisition and straightforward value over badge values.

The rewards will go to those marketers who understand both the psychology and circumstances of the boomers, and who find imaginative ways to reconcile them. Richard Elliott, Professor of Marketing at Warwick Business School, predicts the explosion of the hire market. Those last-chance Harleys won’t be bought, they’ll be rented for the week, or for the summer, and chalked up as another of the great experiences of life.

Raoul Pinnell, Chairman at Shell Brands International, ventures that mobility will be hugely important for this generation as it heads towards its seventh and eighth decades. “We’re looking at value and service propositions to keep them loyal,” he says. Both are based on afternoon times when demand falls off, and the elderly tend to be the main customers. “The value proposition is to offer deals for that period of the day – the other idea is to provide attendant service at the pumps just for those few hours, so they won’t have to haul themselves out of their cars.”

Social and political marketing

The voluntary sector will burgeon, too, as retired boomers seek new outlets for their intellectual and social energies. Just don’t expect it all to be altruistic; we’re talking about the me generation. Boomers will be doughty activists in the fight to protect their state pensions and maximise their rights – and political parties will need to engage, since by 2025 over-60s will outnumber under-25s for the first time. Expect social and political marketing to surge, and watch for a higher-profile face as the Minister for Ageing.

Despite their political clout, boomers will have a fight on their hands. The generation that vowed never to trust anyone over 30 will find younger generations unsympathetic to their suddenly reduced circumstances. Those boomer traits – selfishness, hedonism, insouciance – threaten to boomerang back and wound their credibility. Or will this be just one more challenge the generation will take in its stride? James Murphy of The Future Foundation thinks so. “They won’t become so dependent on welfare, and won’t really retire, they’ll just move into new roles,” he says, citing Anna Ford’s retirement at 62 from the BBC, only to be snapped up as a director of Sainsbury’s.

While the choices open to Ms Ford are not open to everyone you can sort of see his point. This generation tends to surprise, to thrive and to change the rules to suit itself. Slow down in the twilight? Why? Perhaps we’ll find them, like the lyrics of a 1972 T Rex track, ‘Riding like a cowboy/In the graveyard of the night’. The title of that track, as it happens, was Baby Boomerang.